TSLA Free Cashflow Fallacy

Through 2018 TSLA managed to incinerate a whopping $11 billion of free cashflow.

Normally, the market doesn’t take kindly to cash burning at that magnitude, but the Model 3 was rolling out, fully automated vehicles were coming soon (6 months maybe, 12 definitely), solar tiles were just around the corner, etc. etc. The $11b was viewed as an investment in TSLA’s future and soon the cash would be rolling in.

In 2019, TSLA worked hard to support the narrative. With the M3 ramping globally TSLA gave the bulls what they needed and generated $1.1 billion of free cashflow. Helpfully, they even did the math for us saving everyone the trouble of reading their financial statements…

As shown above, 2019 was Tesla’s first cashflow positive year, a cause for celebration! Except, the $1 billion didn’t happen, and 2019 was NOT free cashflow positive. In fact, TSLA managed to lose about $1 billion that year.

TSLA manages its free cashflow sleight of hand two ways, the first is pretty obvious and should be caught by most analysts, the second is better hidden and more impactful. I’ll refer to them as BS1 and BS2.

BS1

Why should depreciation on leased vehicles be added back to operating cashflow? Unlike DDA on PPE, it represents an actual cash cost to TSLA. Leased vehicles are depreciated to the cost basis in the residual value of the cars. It’s a very real cash cost, and one that won’t be recouped. Had TSLA sold those units outright, it would have booked cost of goods sold and wouldn’t have been added back.

Naturally, TSLA does not disclose the amount of DDA attributed to the leased cars so there isn’t a precise figure we can derive. However, we can see how much of their reported depreciation is due to PPE. By adding back the total DDA reported in operating cashflow and then deducting how much came from depreciating PPE, we can get a more accurate representation of true operating cashflow.

BS1 accounts for about $800m of 2019’s reported operating cashflow.

BS2

TSLA makes aggressive and clever use of “finance leases” to add productive assets without having a day one cash outlay. Essentially, TSLA “rents” factories, the Gigafactory in particular. There is nothing wrong about using finance leases to acquire PPE, many companies do it. However, there is something wrong when you don’t make it clear to investors the burden it imposes on free cashflow.

GAAP’s byzantine rules treat these leases bizarrely. The value of the “rented” factory is placed on the balance sheet as both an asset, in PPE, and a liability, in Leases. Since there is no initial cash outlay, there is nothing recorded as cap ex on the cashflow statement. Worse, as the “rent” gets paid back to the lessor, it is booked as “principal payments on finance leases” in cashflow from financing.

The net result is the actual expense of acquiring the factory is completely OMITTED from the free cashflow calculation. This is wrong and needs to be accounted for in any assessment of actual free cashflow. Either one needs to show how much was “paid” to rent the factory, or one needs to show what it’s costing in “rent” each period.

More honest companies understand this and take pains to point out to investors. Amazon has an entire schedule in their earnings release to map this out. Conservatively, AMZN chooses to show the “value” of the rented asset in the period its acquired. This is conservative because they pay for it over time and not necessarily all at once. Below is an example from AMZN’s 1q19 earnings presentation.

“Equipment acquired under finance leases” is being deducted from operating cashflow to alert investors to the capital expenditure AMZN is incurring on those assets.

Additionally, AMZN is showing the “principal repayments” on other finance lease contracts that were not included in that line item. Those principal payments represent actual cash outlays incurred by AMZN.

So how does this relate to TSLA? Well, the market’s favorite vaporware purveyor has acquired over $2b of PPE through the magic of finance lease accounting. Nowhere, does TSLA take pains to point out the impact on free cashflow. Had TSLA bothered to inform investors, they’d point out that their “free cashflow” in 2019 was overstated by at least $754 million.

BS2 accounts for at least $754 of TSLA’s reported 2019 free cashflow

Putting BS1 and BS2 together you get a very different, though more accurate, representation of TSLA’s true cash generation. If they can’t generate cash after record vehicle sales in 2019, when are they going to?

China Reality

Tesla bulls like to point to China, with the world’s largest automobile market, as Tesla’s largest growth opportunity.

The reality is quite different. Tesla’s Chinese operations, including its new Shanghai factory, are completely beholden to the Communist Chinese Party. The CCP has provided Tesla with a land grant for the factory site, and has arranged for state-controlled banks to provide generous financing for construction and working capital. But this generosity comes with a price tag. The CCP expects to reap favorable propaganda from its support of Tesla. And Tesla’s CEO, Elon Musk, has most certainly obliged. In 2019, Musk appeared at the World Artificial Intelligence Conference in Shanghai, where he gave a speech lauding Chinese governmental authorities and announced “China is the future.”

More recently, in an interview with Automotive News, Musk said “China rocks in my opinion,” and praised the Chinese people as “smart” and hard-working” while deploring the “entitled” and “complacent” character of people in “places like the Bay Area, and L.A., and New York.” (This despite the fact Tesla has received hundreds of millions of dollars in tax abatements in California, has benefitted from California’s rebate program to and HOV privileges for EV buyers, and has received $959 million of free factory and equipment from New York.) The Chinese press widely disseminates Musk’s praise of China and the Chinese people, rightly viewing them as a public relations coup.

Moreover, the business realities faced by Tesla in China are far more daunting than the picture often painted by the press. While China has the world’s largest EV market, that market is intensely competitive, price-sensitive, and subsidy-sensitive. It is concentrated at the low end of price points, where Tesla does not and cannot compete. An example is the Wuling Mini, a tiny car with a top price below $5,500, which with 50,000 orders is making a momentous entry into the Chinese scene.

Moreover, the business realities faced by Tesla in China are far more daunting than the picture often painted by the press. While China has the world’s largest EV market, that market is intensely competitive, price-sensitive, and subsidy-sensitive. It is concentrated at the low end of price points, where Tesla does not and cannot compete. An example is the Wuling Mini, a tiny car with a top price below $5,500, which with 50,000 orders is making a momentous entry into the Chinese scene.

At the high end, where Tesla competes, it faces intense competition from dozens of Chinese EV companies, including giants such as Nio (which offers battery swapping) and impressive upstarts such as Xpeng Motors. It also faces competition from EV joint ventures managed by Ford, General Motors, Daimler, BMW, and Volkswagen Group, each of which has its own regional political champions.

Seldom mentioned by either journalists or analysts is the fact that in order to repatriate any Chinese profits to its operations in Fremont (or Austin, or Germany, or anywhere else in the world), Tesla must first repay all its loans to the Chinese banks. These include a factory loan ($1.26 billion) and three working capital lines ($700 million, $315 million, and – most recently – an additional $560 million). In other words, loan lines totaling more than $2.8 billion.

Until all amounts drawn on those lines are repaid in full, no cash can leave the control accounts at Chinese banks except for expenditure in China. Even if Tesla is ultimately able to fully repay the loans, it would face the usual difficulties of foreign countries attempting to repatriate cash from China.

The inability to use any Chinese profits elsewhere in the world is compounded by the fact that the Shanghai factory will be satisfying demand that in the past has been satisfied by Tesla’s Fremont factory. Simply to satisfy the revenue test in the Chinese land grant, Tesla will need to be manufacturing more than 250,000 cars per year in Shanghai by 2023. It’s highly doubtful the Chinese market can soak up all that production; some will be exported to Australia and other Asian countries.

Meanwhile, Fremont, already operating well below its annual capacity of 490,000 cars, will become further inefficient and costly as it loses more customers, a problem that will be exacerbated further when the Brandenburg factory begins production in 2021. All the while, Tesla will continue dancing to the tune called by the Communist Chinese Party, which has reserved the right to revoke its 50-year land grant should there arise “special circumstances” (never defined) arising from the “public interest” or should Tesla fail to meet undefined “relevant standards.”

Further Reading:

- Grant Contract dated October 17, 2018 under which the Chinese government granted Tesla (Shanghai) Co., Ltd. the right to use the factory site for 50 years, subject to various fees and conditions. See especially Article 22 (allowing early revocation under vaguely defined “special circumstances”) and Article 48 (requiring Tesla to meet undefined “relevant standards”).

- Fixed Asset Syndication Loan Agreement dated December 18, 2019 and related Supplemental Agreement under which a consortium of state-controlled Chinese banks extended Tesla (Shanghai) Co., Ltd. a $1.26 billion (RNB 9 billion) loan for building and equipping the Shanghai factory, with a five-year term. See especially Clause 11, requiring Tesla to deposit all operating revenue into so-called Revenue Collection Accounts at Chinese banks, and prohibiting the use of operating revenues for other than Chinese production costs until all loans are repaid.

- Facility Agreement dated September 26, 2019 and related Statement Letter under which a consortium of state-controlled Chinese banks extended Tesla (Beijing) Co., Ltd. a $700 million (RNB 5 billion) loan for facilitating the import and sale of Tesla vehicles, with a one-year term. Syndication Revolving Loan Agreement dated December 18, 2019 under which a consortium of state-controlled Chinese banks extended Tesla (Shanghai) Co., Ltd. a $315 million (RNB 2.25 billion) loan for working capital at the Shanghai factory, with a one-year term.

- Working Capital Loan Agreement dated May 7, 2020 under which Industrial and Commercial Bank of China extended Tesla (Shanghai) Co., Ltd. a $560 million (RNB 4 billion) loan for working capital at the Shanghai factory, with a one-year term.

- Tesla’s Transformation Into A Chinese Company Seems Unstoppable (April 4, 2020), discussing the foregoing agreements.

- How Strong is China’s Leverage Over Tesla? (April 27, 2020), discussing the foregoing agreement.

- Tesla Investors Are Flying Blind In China (August 17, 2020), discussing Tesla’s failure to provide segment reporting under Accounting Standards Codification 280 for its Chinese operations.

- Chinese EV startup Xpeng Motors raises $1.5 billion in US public market debut (August 27, 2020)

- How China Became The World’s Largest Electric Vehicle Market (June 8, 2020)

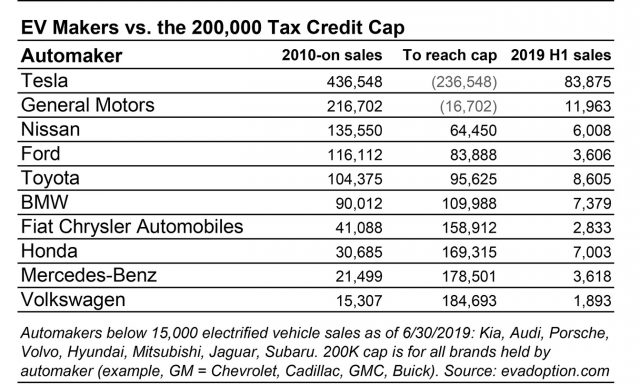

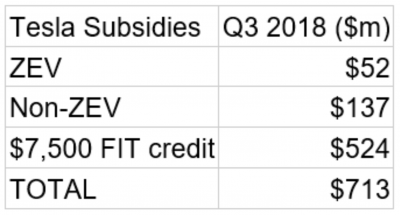

Globally Subsidized

Tesla has gotten more subsidies than any other company ever in excess of $10bn.

Subsidy sources include: CA Direct subsidies, ZEV regime, GHG, CAFE, CA & NV tax abatements, NV free land, cheap electricity, transferable tax credits, NY free $1B factory, no gas tax, endless European subsidies, HOV privileges, and more.

Greater than 100% of its “profitability” is now from selling regulatory credits to other OEM’s, another form of subsidy. Here’s one example of the many:

Greater than 100% of its “profitability” is now from selling regulatory credits to other OEM’s, another form of subsidy. Here’s one example of the many:

Not only has tesla gotten these massive subsidies, they of course use a panoply of frauds to extract even more gravy. Here’s a list of some of their SUBSIDY ABUSE:

- Oregon and Tesla Reach 13 Million Settlement – Oregon solar- per liberal AG of Oregon, Tesla inflated value by 100% and filed false documents- Rosenblum said in a statement, “Unfortunately, some companies abused the program. In this case we have been able to claw millions of tax dollars back from those who sought to cheat the system.”

- Canada: Tesla Registered Vehicles to Themselves

- Canada: Fake Prices

- Tesla & SolarCity’s Crooked Buffalo Deal

- Nevada: Tesla Depends Heavily on Taxpayers

- Pages 84-87 of PlainSite’s Reality Check on Tesla document further subsidy abuse

Warranty Fraud

Ask any accountant and you’ll learn that an automobile warranty expense is properly categorized as part of the cost of making the vehicle.

Yet since at least Q2 of 2018, Tesla in many instances has allocated warranty expense to “Goodwill” and other non-warranty expense categories.

Yet since at least Q2 of 2018, Tesla in many instances has allocated warranty expense to “Goodwill” and other non-warranty expense categories.- Why does that matter? Because it inflates both Tesla’s claimed gross margin and its reported net income.

- A trove of documentation from lawsuits against Tesla suggests the misallocation is pervasive.

- Tesla’s own legal counsel admits the company has a policy of classifying warranty-covered repairs as goodwill.

Despite the marked improvement in the overall quality of automobile manufacture in recent years, every automaker must deal with warranty issues from problems arising with flaws in design or manufacture.

For this reason, when selling a particular model, the automaker creates a warranty reserve equal to the automaker’s estimate of the average cost of the warranty work that car will require while under warranty. The automaker classifies the warranty reserve as a cost of making the car. Like other automakers, and in accordance with sound accounting principles, Tesla (TSLA) books its warranty reserve against “Cost of Revenues.”

The question explored here is whether Tesla is accurately booking its warranty costs. Our contention is that, no, it is understating those warranty costs. It does so by classifying many expenses that should properly fall under warranty as, instead, goodwill. That has two important consequences. First, it exaggerates Tesla’s (already inflated) gross margin. Second, it results in Tesla overstating its net income in both the current quarter and in subsequent near-term quarters.

When a customer brings a car in for service or repairs, Tesla books the work primarily to either (A) customer pay (which becomes revenue in “Services and other” on the income statement); (B) warranty expense (which has no income statement effect, but is deducted from the existing warranty reserve on the balance sheet in either accrued liabilities or long-term liabilities), or (C) a marketing category under the income statement’s “Operating expenses”.

Now for an example:

Let’s assume that upon selling a car, the manufacturer creates a warranty reserve of $1,000 to cover estimated warranty expenses over a five-year warranty period. In each of Years 1 and 2, though, the car requires warranty repairs costing $500. If the manufacturer accounts for this as warranty work, its warranty reserve is exhausted with three years yet to run. The manufacturer must increase the warranty reserve. In other words, it must go back to the income statement to adjust upwards its “Cost of revenues” for “Automotive sales”. That results in a reduction of current period Gross Profit and, by definition, a lower gross margin.

What if the manufacturer instead decides to categorize all or part of the $1,000 repair as “goodwill”? That is still an expense, reducing current period income. However, because the expense now falls under “Operating expenses” rather than “Cost of revenues”, the “Gross profit” number remains the same, and gross margin is artificially inflated. In Tesla’s case, the inflation of gross margin is on top of other accounting practices that significantly inflate Tesla’s claimed gross margins.

A misclassification of warranty repair causes an overstatement not simply of gross margin, but also of Net income on the income statement’s bottom line.

At first blush, that seems counterintuitive: whether classified under a “Cost of revenues” or “Operating expenses”, the cost falls to the bottom line. The issue is in the timing of when those costs get allocated. Manufacturers are supposed to reserve for the whole warranty expense upfront, but because Tesla misclassifies warranty expenses as goodwill they are able to push those expenses out to the time of repair. As long as they are growing, current period income is overstated, and at all times, cumulative net income is overstated.

So, what is the evidence that Tesla is misclassifying some warranty expenses as goodwill? That evidence found in many of the pending lawsuits.

Tesla Inc. (TSLA), its SolarCity subsidiary, and its CEO face hundreds of lawsuits. The legal research website, PlainSite.org, compiles pleadings from some of those lawsuits:

The PlainSite compilation significantly understates the actual number of lawsuits because PlainSite lacks access to cases in many international courts and in some state courts in the U.S. as well.

Most of the pending lawsuits are so called “lemon law” claims by individual car purchasers. The pleadings and attachments reveal important information on internal Tesla accounting practices. (In some instances, the service records are not included in the legal pleadings, but are instead available on social media forums. The evidence in all the instances cited later in this article is publicly available.)

The Tesla invoices often show warranty work being booked not as “warranty,” but rather under “goodwill” and other non-warranty expense categories that fall into the “Operating expenses” category on the income statement. We can determine that these vehicles were warranty eligible both because the lawsuit states the vehicle’s purchase date and because details about the service records show non-warranty repairs alongside repairs that the records describe as covered by warranty.

Let’s go through a few examples. In a New Jersey case called Salvage v. Tesla, the documentation shows that a mobile service visit for non-functioning keys & other problems, all of which would plainly appear to be covered by warranty. However, on the service record, all those charges are classified as goodwill:

Here’s an example from Henry v. Tesla, a lawsuit where Tesla classified repairing problem windows, doors, and air-conditioning as goodwill rather than warranty.

A third example, in a case called Belani v. Tesla, we see Tesla classifying the cost of fixing non-functional seatbelts as goodwill rather than warranty:

What suggests that the misclassification of warranty expense as goodwill is pervasive?

There are seven cases available at the PlainSite that include a full service history for the vehicles that are the subjects of the lawsuits:

Each one of those seven service histories show instances of material misclassification of warranty expenses as goodwill. If that is a coincidence, it is an extraordinary coincidence.

Consider also the problem of the yellowing touchscreens. By July 2019, it had become evident that “Tesla’s most unique feature continues to be one of its biggest headaches, as customers await touchscreen fixes”.

As Edward Neidermeyer’s article details, significant controversy exists about how the problem can be fixed. Tesla acknowledges the problem falls under its warranty, and is offering a so-called ultraviolet light treatment. However, in several cases that have gone to arbitration, the arbitrators have ruled that Tesla’s warranty requires it to replace the defective screens with new ones, which is a significantly more costly fix.

Tesla Battery Swap Fraud

One of the more blatant Tesla scams (that we know of)

This fraud could be part of the Globally Subsidized page of our website, but is so ridiculous that it deserves its own section.

In June 2013, Tesla held an event displaying its battery swap technology, changing the battery pack of a Model S twice during the time it took to fill up the tank of an Audi at a gas station. This made some waves, as Tesla owners could forego the 40 minutes it takes to recharge a Tesla battery pack to 80% of capacity by doing a 90-second battery swap.

In December 2014, Tesla issued a blog on the subject on its website saying that they would begin a “pilot swap program”, but due to technical issues, swap time would actually require 3 minutes but cost “slightly less than a full tank of gasoline for a premium sedan”.

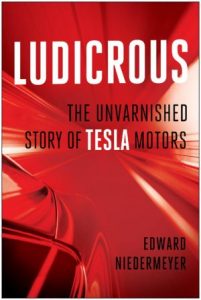

In his book, Ludicrous: The Unvarnished Story of Tesla Motors, Edward Niedermeyer decided to spend a long weekend at Tesla’s large charging center at Harris Ranch, CA to see if he could witness anyone using the Tesla battery swap system. Because of the three-day weekend, the Superchargers had huge lines causing Tesla owners to wait for hours to recharge their cars. Some Tesla owners told Niedermeyer that they’d gladly pay good money to be able to use a swapping service. Over the four days he spent at Harris Ranch, Niedermeyer didn’t see a single battery swap take place.

At Tesla’s shareholder meeting in mid-2015, Elon Musk was asked about the status of battery swap. He said that Tesla had invited 200 Tesla owners to try the service, but only “four or five” showed interest. Jefferies Tesla analyst at the time did a survey showing that 54% of Tesla owners were interested in the swap system. Nevertheless, the question remains why Musk pumped “battery swap” as a great technology, yet never followed through. Niedermeyer has an interesting theory on that front:

“In 2013, California revised its Zero Emissions Vehicle credit system so that long-range ZEVs that were able to charge 80% in under 15 minutes earned almost twice as many credits as those that didn’t. Overnight, Tesla’s 85 kWh Model S went from earning four credits per vehicle to seven. Moreover, to earn this dramatic increase in credits, Tesla needed to prove to CARB that such rapid refueling events were possible. By demonstrating battery swap on just one vehicle, Tesla nearly doubled the ZEV credits earned by its entire fleet even if none of them actually used the swap capability.”

Yet since at least Q2 of 2018, Tesla in many instances has allocated warranty expense to “Goodwill” and other non-warranty expense categories.

Yet since at least Q2 of 2018, Tesla in many instances has allocated warranty expense to “Goodwill” and other non-warranty expense categories.